Paperback

₦8,500.00

Money For Nothing

In the heart of the Scientific Revolution, when new theories promised to explain the affairs of the universe, Britain was broke, facing a mountain of debt accumulated in war after war it could not afford. But that same Scientific Revolution—the kind of thinking that helped Isaac Newton solve the mysteries of the cosmos—would soon lead clever, if not always scrupulous, men to try to figure a way out of Britain’s financial troubles.

Enter the upstart leaders of the South Sea Company. In 1719, they laid out a grand plan to swap citizens’ shares of the nation’s debt for company stock, removing the burden from the state and making South Sea’s directors a fortune in the process. Everybody would win. The king’s ministers took the bait—and everybody did win. Far too much, far too fast. The following crash came suddenly in a rush of scandal, jail, suicide, and ruin. But thanks to Britain’s leader, Robert Walpole, the kingdom found its way through to emerge with the first truly modern, reliable, and stable financial exchange.

Thomas Levenson’s Money for Nothing tells the unbelievable story of the South Sea Bubble with all the exuberance, folly, and the catastrophe of an event whose impact can still be felt today.

Out of stock

Related products

How To Turn Down A Billion Dollars: The Snapchat Story

₦4,500.00The improbable and exhilarating story of the rise of Snapchat from a frat boy fantasy to a multi-billion dollar internet unicorn that has dramatically changed the way we communicate.

In 2013 Evan Spiegel, the brash CEO of the social network Snapchat, and his co-founder Bobby Murphy stunned the press when they walked away from a three-billion-dollar offer from Facebook: how could an app teenagers use to text dirty photos dream of a higher valuation? Was this hubris, or genius?

In How to Turn Down a Billion Dollars, tech journalist Billy Gallagher takes us inside the rise of one of Silicon Valley’s hottest start-ups. Snapchat developed from a simple wish for disappearing pictures as Stanford junior Reggie Brown nursed regrets about photos he had sent. After an epic feud between best friends, Brown lost his stake in the company, while Spiegel has gone on to make a name for himself as a visionary―if ruthless―CEO worth billions, linked to celebrities like Taylor Swift and his wife, Miranda Kerr.

An Ugly Truth: Inside Facebook’s Battle for Domination

₦15,000.00Award-winning New York Times reporters Sheera Frenkel and Cecilia Kang unveil the tech story of our times in a riveting, behind-the-scenes exposé that offers the definitive account of Facebook’s fall from grace.

Once one of Silicon Valley’s greatest success stories, Facebook has been under constant fire for the past five years, roiled by controversies and crises. It turns out that while the tech giant was connecting the world, they were also mishandling users’ data, spreading fake news, and amplifying dangerous, polarizing hate speech.

The company, many said, had simply lost its way. But the truth is far more complex. Leadership decisions enabled, and then attempted to deflect attention from, the crises. Time after time, Facebook’s engineers were instructed to create tools that encouraged people to spend as much time on the platform as possible, even as those same tools boosted inflammatory rhetoric, conspiracy theories, and partisan filter bubbles. And while consumers and lawmakers focused their outrage on privacy breaches and misinformation, Facebook solidified its role as the world’s most voracious data-mining machine, posting record profits, and shoring up its dominance via aggressive lobbying efforts.

Drawing on their unrivaled sources, Sheera Frenkel and Cecilia Kang take readers inside the complex court politics, alliances and rivalries within the company to shine a light on the fatal cracks in the architecture of the tech behemoth. Their explosive, exclusive reporting led them to a shocking conclusion: The missteps of the last five years were not an anomaly but an inevitability—this is how Facebook was built to perform. In a period of great upheaval, growth has remained the one constant under the leadership of Mark Zuckerberg and Sheryl Sandberg. Both have been held up as archetypes of uniquely 21st century executives—he the tech “boy genius” turned billionaire, she the ultimate woman in business, an inspiration to millions through her books and speeches. But sealed off in tight circles of advisers and hobbled by their own ambition and hubris, each has stood by as their technology is coopted by hate-mongers, criminals and corrupt political regimes across the globe, with devastating consequences. In An Ugly Truth, they are at last held accountable.

Think and Grow Rich

₦4,500.00Think and Grow Rich has been called the “Granddaddy of All Motivational Literature.” It was the first book to boldly ask, “What makes a winner?” The man who asked and listened for the answer, Napoleon Hill, is now counted in the top ranks of the world’s winners himself.

The most famous of all teachers of success spent “a fortune and the better part of a lifetime of effort” to produce the “Law of Success” philosophy that forms the basis of his books and that is so powerfully summarized in this one.

In the original Think and Grow Rich, published in 1937, Hill draws on stories of Andrew Carnegie, Thomas Edison, Henry Ford, and other millionaires of his generation to illustrate his principles. In the updated version, Arthur R. Pell, Ph.D., a nationally known author, lecturer, and consultant in human resources management and an expert in applying Hill’s thought, deftly interweaves anecdotes of how contemporary millionaires and billionaires, such as Bill Gates, Mary Kay Ash, Dave Thomas, and Sir John Templeton, achieved their wealth. Outmoded or arcane terminology and examples are faithfully refreshed to preclude any stumbling blocks to a new generation of readers.

The Man Who Knew

₦8,000.00Greenspan’s life is a quintessential American success story: raised by a single mother in the Jewish émigré community of Washington Heights, he was a math prodigy who found a niche as a stats-crunching consultant. A master at explaining the economic weather to captains of industry, he translated that skill into advising Richard Nixon in his 1968 campaign. This led to a perch on the White House Council of Economic Advisers, and then to a dazzling array of business and government roles, from which the path to the Fed was relatively clear. A fire-breathing libertarian and disciple of Ayn Rand in his youth who once called the Fed’s creation a historic mistake, Mallaby shows how Greenspan reinvented himself as a pragmatist once in power. In his analysis, and in his core mission of keeping inflation in check, he was a maestro indeed, and hailed as such. At his retirement in 2006, he was lauded as the age’s necessary man, the veritable God in the machine, the global economy’s avatar. His memoirs sold for record sums to publishers around the world.

But then came 2008. Mallaby’s story lands with both feet on the great crash which did so much to damage Alan Greenspan’s reputation. Mallaby argues that the conventional wisdom is off base: Greenspan wasn’t a naïve ideologue who believed greater regulation was unnecessary. He had pressed for greater regulation of some key areas of finance over the years, and had gotten nowhere. To argue that he didn’t know the risks in irrational markets is to miss the point. He knew more than almost anyone; the question is why he didn’t act, and whether anyone else could or would have. A close reading of Greenspan’s life provides fascinating answers to these questions, answers whose lessons we would do well to heed. Because perhaps Mallaby’s greatest lesson is that economic statesmanship, like political statesmanship, is the art of the possible. The Man Who Knew is a searching reckoning with what exactly comprised the art, and the possible, in the career of Alan Greenspan.

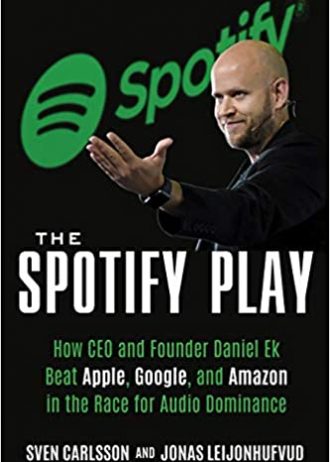

The Spotify Play: How CEO and Founder Daniel Ek Beat Apple, Google and Amazon in the Race for Audio Dominance

₦8,500.00Steve Jobs tried to stop this moment from ever happening. Google and Microsoft made bids to preempt it. The music industry blocked it time and again. Yet, on a summer’s eve in 2011, the whiz kid CEO of a Swedish start-up celebrated his company’s US launch.

In the midst of the Apple-Android tech war and a music label crusade against piracy and illegal downloading, Spotify redrew the battle lines, sent shockwaves through Silicon Valley, and got the hardline executives at Universal, Sony, and Warner to sign with its “free-mium” platform.

In The Spotify Play, now adapted into an upcoming Netflix Original series, Swedish investigative tech journalists Sven Carlsson and Jonas Leijonhufvud, who covered the company from its inception, draw upon hundreds of interviews, previously untapped sources, and in-depth reporting on figures like Mark Zuckerberg, Sean Parker, Steve Jobs, Taylor Swift, Jay-Z, Pony Ma Huateng, and Jimmy Iovine. They have captured the riveting David vs. Goliath story of a disruptive innovator who played the industry giants in a quest to revolutionize the consumption of sound, building today’s largest online source of audio, with more than 50 million songs, one million-plus podcasts, and over 300 million users.

Reviews

There are no reviews yet.